Introduction

If you’re looking into corporate reorganization options, the term f reorg may pop up as a key strategy. A f reorg is a type of corporate restructure governed by Internal Revenue Code § 368(a)(1)(F) that allows a corporation to change its identity, form, or place of organization while staying essentially the same for tax purposes. This flexibility makes the f reorg a valuable tool in deal structuring, especially when a buyer or seller aims for tax efficiency and operational continuity.

The concept of a f reorg revolves around the idea of a “mere change” in the corporation’s legal makeup rather than a full-scale merger or asset sale, which means the tax history and many rights of the corporation remain intact. In practical terms, companies often use a f reorg in preparation for an acquisition, to convert entity types (for example from a corporation to an LLC), or to re-domicile in another state.

What Exactly Is a f reorg?

Definition and Basics

A f reorg is defined as a “mere change in identity, form, or place of organization of one corporation, however effected.” This means the corporation before and after the transaction is essentially treated as the same entity for federal tax purposes—despite the legal form changing.

The key requirements include maintaining the same owners in the same proportions, having no more than one predecessor and one successor corporation, and ensuring the resulting entity does not hold assets or tax attributes immediately before the transaction (apart from minor exceptions).

How It Works

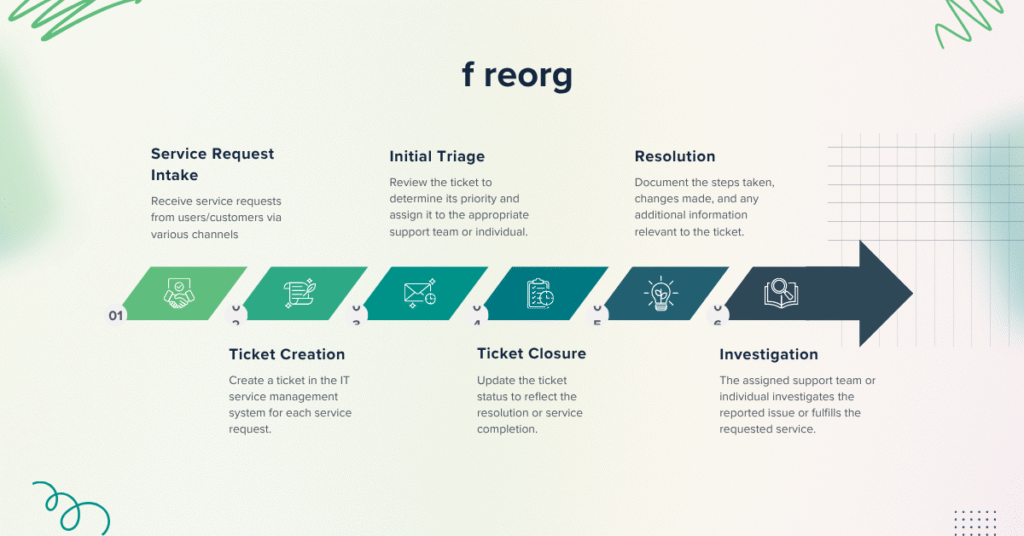

Typical steps in a f reorg might include:

- Owners of the target corporation form a new corporation (NewCo).

- The target corporation’s shareholders contribute their shares of the target to NewCo in exchange for NewCo shares, making the target a wholly-owned subsidiary.

- NewCo makes a QSub election so that the target is treated as a Qualified Subchapter S Subsidiary (if applicable).

- Often followed by a state law conversion of the target into a single-member LLC (SMLLC) or similar pass-through form.

Each deal may vary, but these are common elements of the f reorg path.

Why Companies Use a f reorg

Benefits for Buyers

For a buyer, a well-structured f reorg offers significant advantages:

- The buyer can treat the transaction as though they purchased assets (enabling a step-up in tax basis of the assets acquired).

- It eliminates the need to purchase 80% or more of the target’s stock, giving more flexibility.

- It helps preserve the target’s identification number (EIN), contract history, and operational continuity, reducing disruption.

Benefits for Sellers

Sellers can also gain from the f reorg:

- The structure allows a tax-deferred rollover of equity when certain conditions are met.

- Sellers might achieve higher after-tax proceeds because the buyer receives asset treatment while the seller sells equity.

- The transaction process can avoid many of the complexities found in other types of reorganizations or asset sales.

Other Strategic Uses

Beyond the buyer-seller dynamic, a f reorg may be used to:

- Convert a corporation into another entity type or change its state of incorporation without triggering immediate tax consequences.

- Prepare for a future public offering or investor entry by reworking the entity structure while preserving attributes.

Implementing a f reorg: What to Know

Timing and Compliance

Timing and sequencing matter. The transaction must meet all six criteria:

- Distribution of resulting corporation stock for transferor stock

- Identity of stock ownership

- No prior assets of resulting entity

- Liquidation of transferor

- Single acquiring and single acquired corporation

- Continuity of ownership

Mis-timing or mis-execution can lead to losing the tax-free treatment, so careful planning and consultation with tax/legal advisors is essential.

Practical Considerations

- Ensure the resulting corporation doesn’t hold significant assets before the reorganization.

- Confirm shareholder and ownership continuity.

- Account for state law conversions (corporation to LLC) if required.

- Consider how the target’s S election or QSub election will carry forward or transition.

- Be aware of dissenting shareholders, transfer taxes, state law requirements, and operational disruptions.

Real-World Insight

In one deal, a small business structured a f reorg just ahead of a sale. The owners formed NewCo, contributed their shares, made the QSub election, and then converted the subsidiary to an LLC. Because the buyer was a pass-through entity, this allowed the buyer to get a basis step-up without triggering many consents. This planning saved weeks of negotiation and allowed the owners to stay involved post-transaction via rollover equity.

Another company used a f reorg to move its domicile from one state to another to gain regulatory benefits. Because the reorganization was treated as the same entity for tax purposes, the business avoided an immediate tax event but obtained the strategic benefits of state change.

That kind of smooth transition is exactly what the f reorg can deliver when done right.

When a f reorg Might Not Be the Right Choice

While powerful, the f reorg is not a one-size-fits-all solution. Watch out for these situations:

- If new investors will significantly change ownership proportions.

- If the target has already transferred assets or liabilities to other entities.

- If the resulting corporation holds assets before the reorganization.

- If timing is too tight to properly execute the steps.

In those cases, alternative structures like asset sales, drop-downs, or other reorganization types may be more appropriate.

How to Get Started with a f reorg

- Identify that your company (or target) is an S corporation and consider whether a restructure is upcoming.

- Engage a tax advisor and legal counsel familiar with IRC § 368(a)(1)(F) and Treasury Regulation § 1.368-2(m).

- Map out ownership, assets, and entity history to confirm eligibility.

- Form NewCo (if needed), effect the contribution/exchange, make QSub election (if applicable), and plan any conversion in the proper sequence.

- Confirm that the buyer/seller structure aligns with goals: step-up for buyer, rollover for seller, minimal consents, continuity of operations.

- Execute and monitor: ensure all state filings, federal elections, and regulatory consents are processed correctly.

FAQs About f reorg

Q: Is a f reorg always tax-free?

A: Generally yes, if the requirements of IRC § 368(a)(1)(F) and Treasury Regulation § 1.368-2(m) are met—but mistakes can make it taxable.

Q: Can a f reorg involve multiple companies or more than one acquiring entity?

A: No. Only one predecessor and one successor corporation can be involved.

Q: Does a f reorg require the target to be an S corporation?

A: Not always, but many benefits (especially in private equity deals) apply best to S corporations.

Q: What advantages does a f reorg have over a standard asset sale?

A: The buyer gets asset treatment (step-up in basis) while the seller sells equity, allowing smoother transitions and preserving continuity of business operations.

Final Thoughts

A f reorg is a highly strategic tool in the corporate restructuring playbook. It offers a way to change the legal identity, form, or place of a corporation without losing tax continuity, making it especially useful for S corporations preparing for sale, private equity acquisitions, or internal transitions.

While the rules are technical and sequencing matters, when done correctly a f reorg gives buyers and sellers alike a “win-win” scenario—buyers achieve step-up in basis; sellers maintain favorable tax treatment and potentially remain invested in the business.

If you’re facing a transaction involving entity conversion, sale of a closely held business, or repositioning for growth, the f reorg concept is worth exploring. With careful planning and good counsel, it can turn a complex restructure into something clean, efficient, and tax-smart.